BankTrack has launched Fossil Bank No Thanks, “a new campaign platform that brings together organizations and campaigns from all over the world pressuring commercial banks to stop financing the fossil fuel industry.” In addition to tracking bank financing of fossil fuels, their interactive platform allows people to find and engage with campaigns and organizations in the global push against the industry.

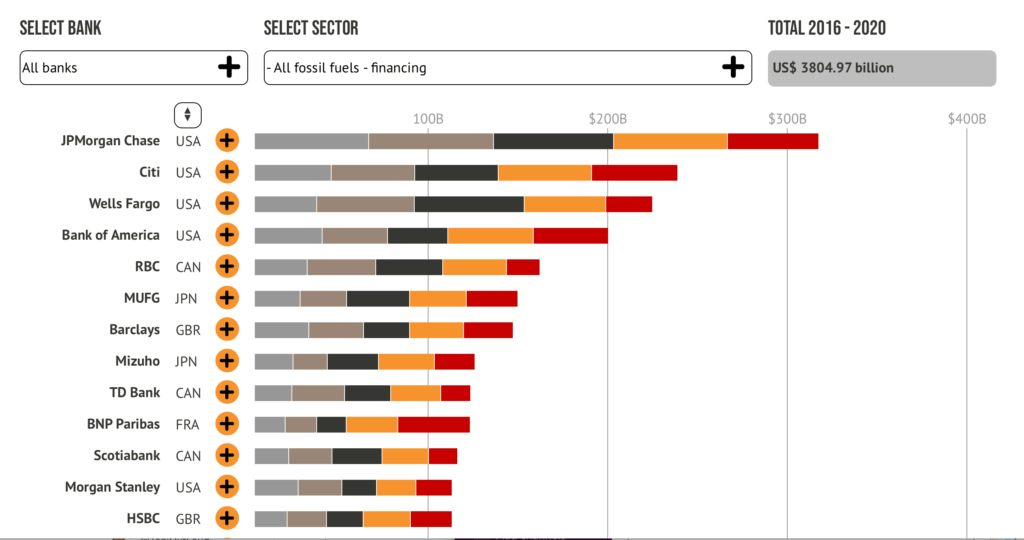

A 2021 report they co-published with the Rainforest Action Network on “Banking on Climate Chaos,” found that “the 60 largest banks in the world poured $3.8 trillion into the fossil fuel industry since the Paris Climate Agreement was adopted at the end of 2015.” The report notes:

Five years have passed since the Paris Agreement was adopted — when a line in the sand was drawn that should have indicated a real beginning to serious, concerted action on climate. Thus it is shocking that this report finds that fossil fuel financing (lending and underwriting) from the world’s 60 largest commercial and investment banks was higher in 2020 than it was in 2016.

It is particularly disturbing that big banks funnelled more money into fossil fuels last year than in the year of the Paris Agreement’s infancy, given that 2020 was such a calamitous year for the fossil fuel industry. The need to lock down much of the world economy in response to the COVID-19 pandemic resulted in what was probably the largest year-on-year drop in global fossil fuel consumption since coal was first stoked into the steam engines of the cotton mills of Northern England. According to the International Energy Agency, usage of oil, coal, and gas fell in 2020 by 8%, 7%, and 3%, respectively. As a result of this decline in fossil fuel burning, global carbon dioxide (CO2) emissions are estimated to have dropped by 7% in 2020.

BankTrack is also one of the leading organizations behind urging banks to stop the financing of the EACOP pipeline in Uganda, alongside our grantee Africa Institute for Energy Governance (AFIEGO). Learn more about the campaign here.